How are intelligent automation technologies revolutionizing the BFSI Industry?

Picture this: it's a busy Monday morning, and you need to get some banking transaction done before work. You walk into your local bank branch, and you see the tellers and other staff members frantically working to keep up with the demand. But amidst the chaos, you notice something different - some tasks are being performed by machines. That's the magic of Intelligent Automation platform, a game-changing technology that is revolutionizing the BFSI industry.

The BFSI sector is turning to Intelligent Automation to stay ahead of the curve and streamline their business processes. Of all the cutting-edge technologies shaping the BFSI industry, Intelligent Automation is one of the most effective solutions for businesses to achieve a quicker and more seamless flow of their operations.

The banking and finance industry can be incredibly complex, making it a challenge for the human workforce to manage everything. That's where Intelligent Automation comes in - it can rescue the banking industry from any potential hiccups and reduce errors.

But what exactly is Intelligent Automation, and how does it benefit the BFSI sector? Let's dive in and find out.

What is Intelligent Automation?

Intelligent Automation combines the power of AI, RPA, ML, and leading technologies to reduce cycle time, improve accuracy, enhance productivity, and deliver better outcomes. Businesses use Intelligent Automation to accelerate digital transformation, automate repetitive tasks, free-up resources, improve operational efficiency, and simplify various business processes.

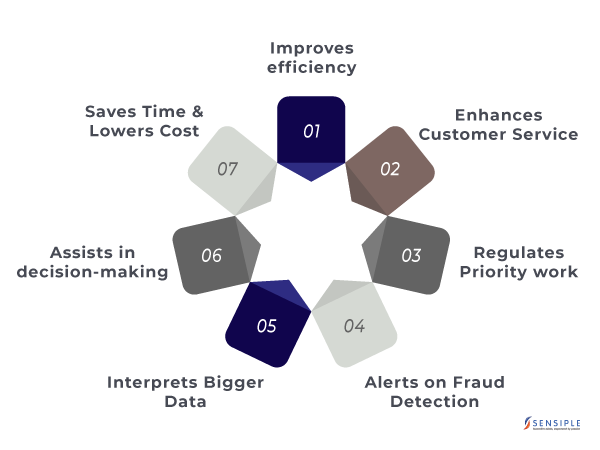

What are the benefits of Intelligent Automation in the banking industry?

- Improves efficiency - Intelligent Automation will accelerate the business and back-office processes that will help enhance process efficiency

- Enhances Customer Service - Businesses will get real-time access to customer details, speed up the resolution of customer requests, and identify service needs in a better way

- Regulates Priority work - Intelligent Automation will regulate business tasks and ensure efficient work routines without manual interference, helping employees focus on priority tasks

- Alerts on Fraud Detection - Using Intelligent Automation, banks, and financial institutions will gain robust security to avoid suspicious and fraudulent activities

- Interprets Bigger Data - Businesses can make informed decisions by effectively handling and interpreting large amounts of data more quickly

- Assists in decision-making - Intelligent Automation augments human decision-making capabilities and assists humans in making better decisions

- Saves Time & Lowers Cost - Automation of business processes saves time and increases focus on priority tasks, thus saving cost for the businesses

How is Intelligent Automation revolutionizing the BFSI Industry?

Intelligent Automation is transforming the BFSI sector at an unprecedented pace. The BFSI industry is facing immense pressure to improve business outcomes while simultaneously lowering operational costs. However, there are numerous challenges associated with banking and finance processes that make it difficult for BFSI institutions to keep up with these demands. Fortunately, adopting Intelligent Automation testing can help overcome these obstacles.

By leveraging this cutting-edge technology, BFSI institutions can significantly reduce costs while also delivering an enriched experience to employees and customers alike. With Intelligent Automation, financial organizations can streamline their operations, improve efficiency, and minimize errors. This not only saves time and money, but also enhances the overall customer experience.

1. Banking Industry

- Regulates banking staff for priority work - The daily routine of bank employees revolves around time-consuming and repetitive tasks. Intelligent Automation will automate their tasks to deliver more accuracy and allow them to focus on priority tasks without distractions

- Allows creation of remote bank accounts - Now, customers need not physically visit their banks as Intelligent Automation ensures the remote creation of accounts for the customers. Customers can complete registration and submit details or documents online without delay

- Removes complexity in the general ledger - The bank staff must maintain and update the ledger daily, which becomes a crucial yet tedious task. With the adoption of Intelligent Automation, banks can collect, update, and check significant volumes of information from multiple sources more effectively and quickly

2. Finance Sector

- Simplifies the process for application validation - Manual validation of applications takes more time and effort. Intelligent Automation technologies like NLP, OCR, etc., will ensure the automatic process of documents in a short time

- Prevents fraudulent activities - Intelligent Automation ensures monitoring of real-time transactions and helps to analyze the transaction patterns to thwart any fraudulent activities by timely alerts to the respective people

- Facilitates financial audits - Financial audits involve complex tasks like evaluating financial statements, verifying payable amounts, tax calculations, etc. With the use of Intelligent Automation, such tasks can be automated to avoid any form of errors

3. Insurance Sector

- Delivers accurate credit risk assessment - Intelligent Automation in the insurance sector can smartly screen prospective borrowers and give them a risk score based on their capacity to repay loans. Insurance institutions can be well informed of loan or credit approval and rejection decisions

- Guarantees quicker claim processing - Insurance agents are put through difficult times during the claim processing, and it takes several days to complete the process. Intelligent Automation helps complete claim processing and settlements more quickly and effectively by avoiding errors

- Gives expert insights - Intelligent Automation can track and record the customer history and renders expert insights to recommend customer policies. Customers can manage their money smartly, and this helps in improved customer experience

What is the future of Intelligent Automation for Banking?

Deploying Intelligent Automation Platforms will make the processes faster, more secure, and trackable. Any form of physical bank visits, long-standing queues, awaiting working hours, or business days to initiate the bank activities can now be performed at your convenience, making even national or international transfers easier and quicker.

Intelligent Automation will empower customers to have complete control over their money. Financial institutions are expected to restructure their operations in the next decade by integrating digital currencies for a better user experience. Innovation begins by ensuring complete ownership for mitigating risks associated with online transactions. Any form of fraudulent activity will be curbed, and the authentication of one’s identity can be executed virtually worldwide.

How to begin with Intelligent Automation in banking?

According to a report by Accenture, financial services are steadily generating up to $140 billion in productivity gains and savings by modernizing workforce technologies.

Many banking institutions find it difficult to know where to initiate their intelligent automation strategy. Before implementing Intelligent Automation across the board, they can start small and focus more on the value that can be delivered. The first step is to identify the manual processes that can improve the efficiency of Intelligent Automation. Then, re-think your workflows, make essential organizational changes, and begin with structured tasks. After the value of Intelligent Automation is visible, proceed with process automation, including emails, insurance forms, applications, and identity documentation.

What can Sensiple do for your BFSI business?

At Sensiple, we believe in harnessing the power of modern technology like AI, ML, and analytics to simplify operations and enhance user experience. Our goal is to provide our clients with a competitive edge in the market.

For the BFSI industry, our solutions are designed to run on robust cloud platforms such as MS Azure, Google Cloud Platform, and AWS. This enables our clients to optimize customer journeys and prevent fraudulent activities. With our Intelligent Automation services, we help the sector gain deeper insights by modernizing applications and automating business processes.

We're passionate about helping businesses succeed, and we'd love to discuss how we can help you. Contact us at info@sensiple.com to schedule a quick consultation with our experts and learn more about our automation services and solutions.